2QFY2017 Result Update | HFC

October 28, 2016

Dewan Housing Finance

ACCMULATE

CMP

`325

Performance Highlights

Target Price

`350

Investment Period

12 months

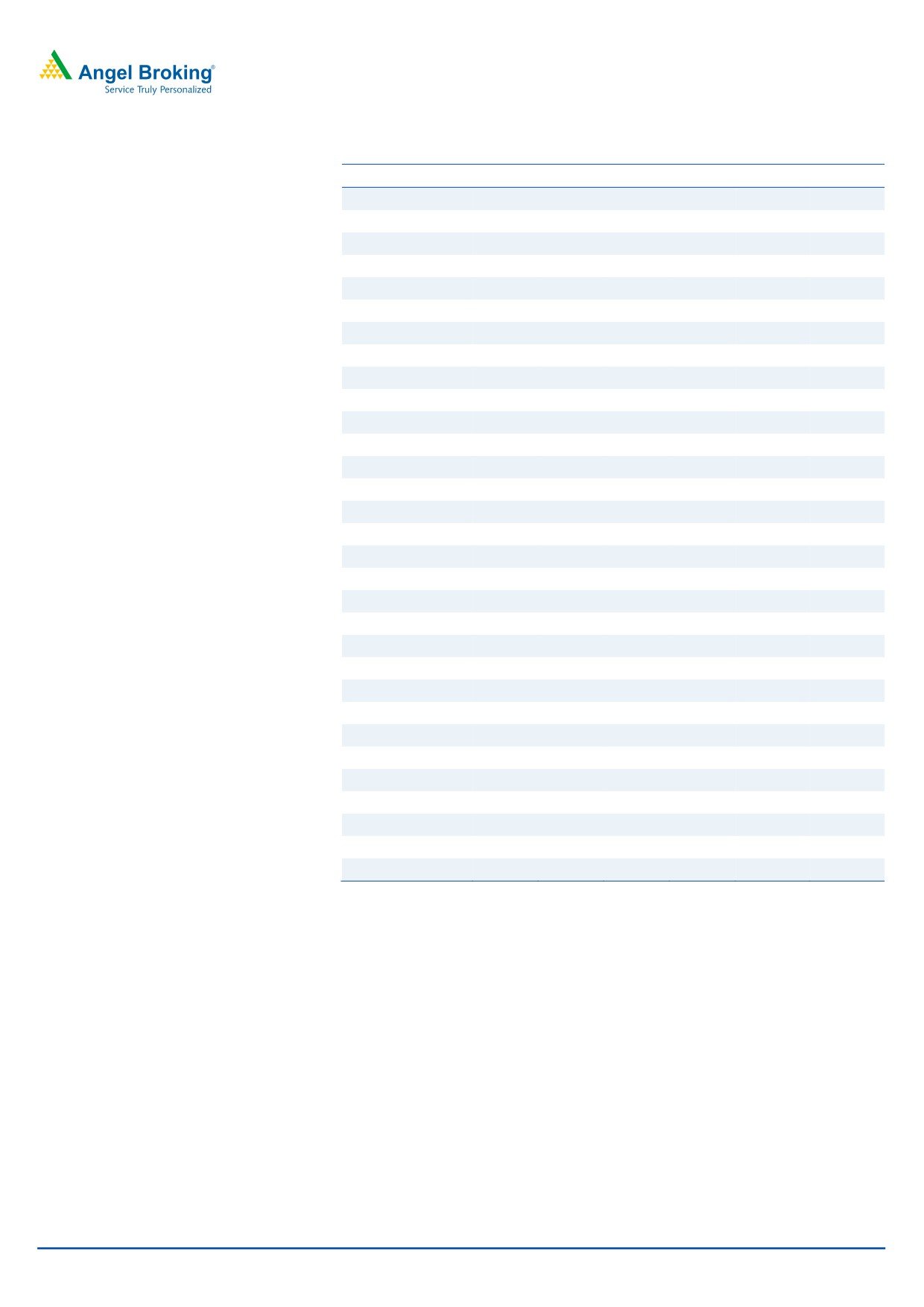

Particulars (` cr)

2QFY17 1QFY17

% chg (qoq) 2QFY16

% chg (yoy)

NII

492

457

7.7

407

20.9

Stock Info

Pre-prov. profit

396

348

13.8

323

22.7

Sector

HFC

PAT

232

201

15.2

181

27.9

Source: Company, Angel Research

Market Cap (` cr)

10,162

Dewan Housing Finance Corporation Limited (DHFL) reported 28.5% growth in

Beta

1.7

PAT at `231.5cr for the quarter, better than our expectations. Strong growth in

52 Week High / Low

337/141

loans, decline in cost of funds and resultant NIM improvement, together with cost

rationalization were the key factors that have supported the earnings growth.

Avg. Daily Volume

1,690,705

Loan growth remained strong: DHFL reported a 19.7% yoy growth in AUM to

Face Value (`)

10

`75,223cr. In absolute terms, the AUM grew by `3,211cr qoq. While sanctions

BSE Sensex

27,196

remained moderate, up by only 10% yoy, disbursements growth accelerated to

32% compared to 26% in 1QFY17. During the quarter, the company securitized

Nifty

8,615

loans worth `2,223 cr compared to `1,152cr in 1QFY17 and securitized portfolio

Reuters Code

DWNH.BO

accounted for 13% of the AUM.

DHFL continued to aggressively expand Project loan book: Loans to individuals

Bloomberg Code

DEWH.IN

reported a moderate growth of 12% yoy (70% of the AUM). However, DHFL

continued to aggressively expand its project loan book, primarily the loans to

projects, which went up by 129% yoy and accounted for 11.5% of the AUM

Shareholding Pattern (%)

compared to 9.8% qoq.

Promoters

37.4

Asset quality remained stable: Though in 1QFY17, we saw a marginal increase in

GNPAs, DHFL has been able to contain its asset quality during the quarter and

MF / Banks / Indian Fls

3.9

GNPAs stood at 0.96% vs 0.98% qoq. Despite aggressive growth in the non retail

FII / NRIs / OCBs

29.5

loan book in the recent quarters, DHFL has been able to maintain strong asset

quality and we don’t expect any change in trend in the near term.

Indian Public / Others

29.2

NIM expanded backed by low cost of funds: During 2QFY17, DHFL successfully

raised `14,000cr via NCDs at a very competitive rate and hence, it has been able

to reduce its cost of funds by 23 bps qoq. This has helped in improving its NIM by

Abs. (%)

3m

1yr

3yr

14 bps qoq to 3.05%. While in the near term the margins will remain stable, we

Sensex

(0.4)

2.4

35.0

believe the company could pass on some benefits of lower cost to gain market

share and thereby further try to accelerate its loan book.

DHFL

46.2

39.3

347.9

Outlook and valuation: DHFL’s 1HFY17 performance has been in line with

expectations on all counts. Going ahead, we expect it to post a healthy AUM

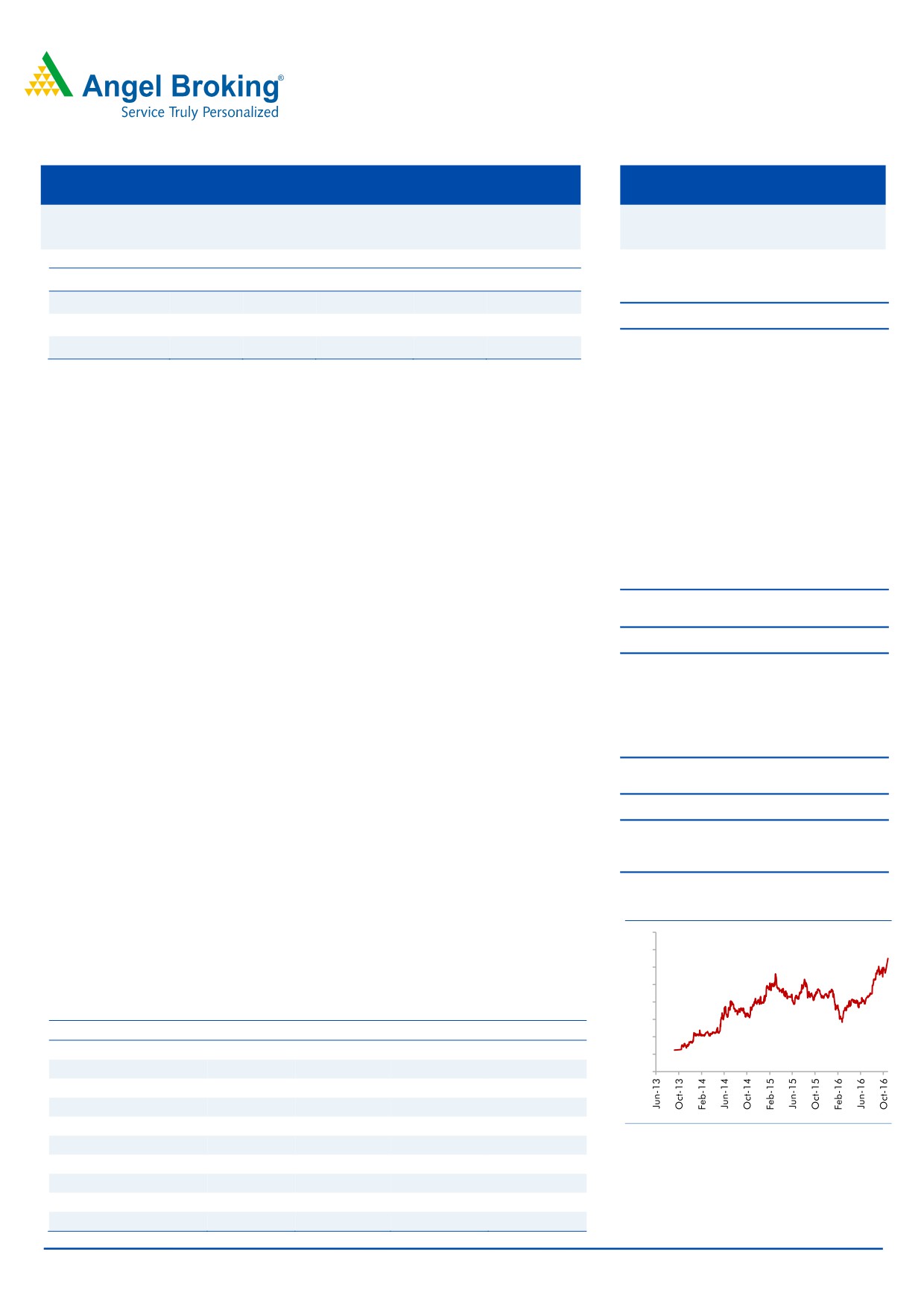

3-Year Daily Price Chart

CAGR of 21% over FY2015-18E, which is likely to translate in earnings CAGR of

23%, over the same period. The stock price has seen sharp run-up in the last two

400

quarters and despite of that is trading at a discount to other HFCs.

350

At the current level, the stock is valued at 1.5x FY2018E ABV. We have revised our

300

target price to `350 and maintain ACCMULATE on the stock.

250

200

Key financials (standalone)

150

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

100

NII

1,256

1,664

2,050

2,500

50

% chg

41.5

32.5

23.2

21.9

-

Net profit

620

729

879

1,111

% chg

17.8

17.6

20.6

26.3

NIM (%)

2.8

2.9

2.9

2.9

Source: Company, Angel Research

EPS (`)

21.3

24.9

28.1

35.5

P/E (x)

15.3

13.1

11.6

9.2

P/ABV (x)

2.3

2.0

1.7

1.5

Siddharth Purohit

RoA (%)

1.3

1.2

1.2

1.2

022 - 3935 7800 Ext: 6872

RoE (%)

15.1

15.0

15.6

16.5

Source: Company, Angel Research; Note: CMP as of October 27, 2016

Please refer to important disclosures at the end of this report

1

Dewan Housing Finance | 2QFY2017 Result Update

Exhibit 1: 2QFY2017 performance (standalone)

Particulars (` cr)

2QFY17

1QFY17

% chg (qoq)

2QFY16

% chg (yoy)

1HFY17

1HFY16

% chg

Interest earned

2,123

1,932

9.9

1,764

20.4

4,055

3397

19.4

Interest expenses

1,631

1,475

10.6

1,357

20.2

3,106

2591

19.9

Net interest income

492

457

7.7

407

20.9

949

806

17.8

Non Interest Income

44

27

63.0

48

(8.3)

71

68

4.3

Operating income

536

484

10.7

455

17.8

1020

874

16.7

Operating expenses

133

130

2.3

125

6.4

263

245

7.4

Depreciation

7

6

13.5

7

(2.7)

13

12.7

0.9

Pre-prov. profit

396

348

13.8

323

22.7

744

616

20.8

Provisions & cont.

45

45

-

45

-

90

77

16.9

PBT

351

303

15.9

278

26.3

654

539

21.3

Prov. for taxes

120

102

17.3

97

23.3

222

185

19.8

PAT

232

201

15.2

181

27.9

433

354

22.1

EPS (`)

7.4

6.9

7.4

6.2

19.2

13.8

12.1

13.8

Effective tax rate (%)

34.1

33.7

34.9

33.9

34.30

Source: Company, Angel Research

Loan growth remained strong during the quarter also: DHFL reported a 19.7% yoy

growth in AUM to `75,223cr. In absolute terms, the AUM grew by 4.5% qoq to

`3,211cr. While sanctions remained moderate by only 10% yoy, disbursements

growth accelerated to 32% compared to 26% in Q1FY17. During the quarter, the

company securitized loans worth `2,223cr compared to `1,152cr in Q1FY17 as

well as securitized portfolio accounted for 13% of the AUM. Lower cost of funds

and well capitalized balance sheet should help the company in accelerating its

loan book in the next couple of quarters.

DHFL continued to aggressively expand Project loan book: Loans to individuals

reported a moderate growth of 12% yoy (70% of the AUM). However, DHFL

continued to aggressively expand its project loan book, primarily the loans to

projects, which went up by 129% yoy and accounted for 11.5% of the AUM

compared to 9.8% qoq. Though growth in the project segments has been very

aggressive in the last few quarters, DHFL’s funding at entire project level rather

than working capital funding makes it much safer compared to what it is perceived

to be.

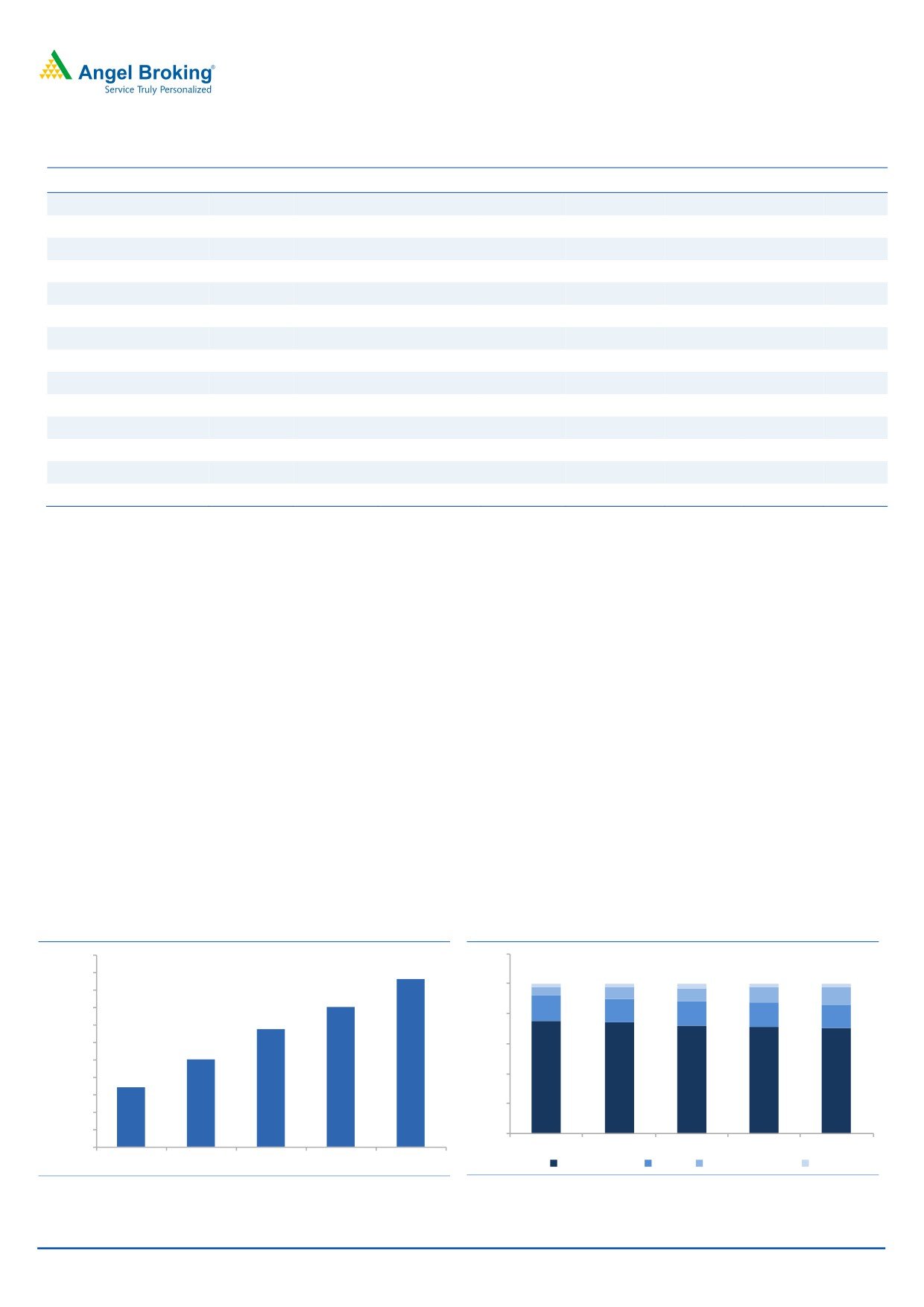

Exhibit 2: AUM growth remained strong

Exhibit 3: Loan Mix

120%

78,000

75,223

76,000

2%

2%

3%

100%

3%

3%

74,000

6%

72,012

8%

9%

10%

12%

72,000

17%

80%

16%

16%

69,524

16%

16%

70,000

68,000

60%

65,962

66,000

62,837

40%

64,000

75%

74%

72%

72%

70%

62,000

20%

60,000

58,000

0%

56,000

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Home Loans

LAP

Project Finance

Others

Source: Company, Angel Research

Source: Company, Angel Research

October 28, 2016

2

Dewan Housing Finance | 2QFY2017 Result Update

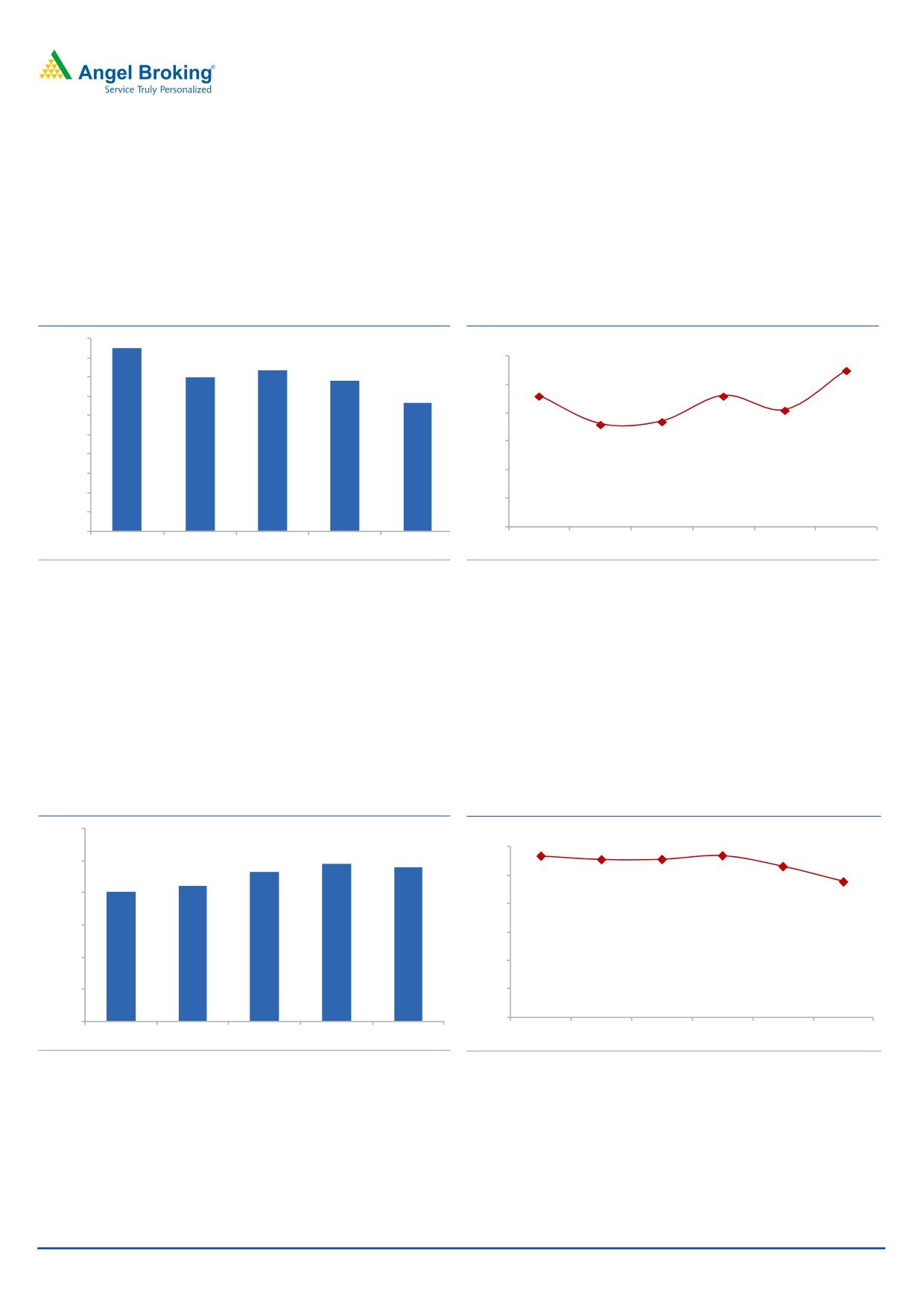

NIM expanded backed by low cost of funds: During Q2FY17, DHFL successfully

raised `14,000cr via NCDs at a very competitive rate and hence, it has been able

to reduce its cost of funds by 23bps qoq. This has helped in improving its NIM by

14 bps qoq to 3.05%. While in the near term the margins will remain stable, we

believe the company could pass on some benefits of lower cost to gain market

share and thereby further try to accelerate its loan book.

Exhibit 4: Reduction in cost of funds

Exhibit 5: Sharp rise NIM due to low cost of funds

10.00%

9.90%

(%)

3.1

3.05

9.80%

9.67%

9.60%

9.56%

9.60%

3.0

2.96

3.0

9.33%

2.91

9.40%

2.86

2.87

9.20%

2.9

9.00%

2.8

8.80%

8.60%

2.7

8.40%

2.6

8.20%

2.5

8.00%

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Source: Company, Angel Research

Source: Company, Angel Research

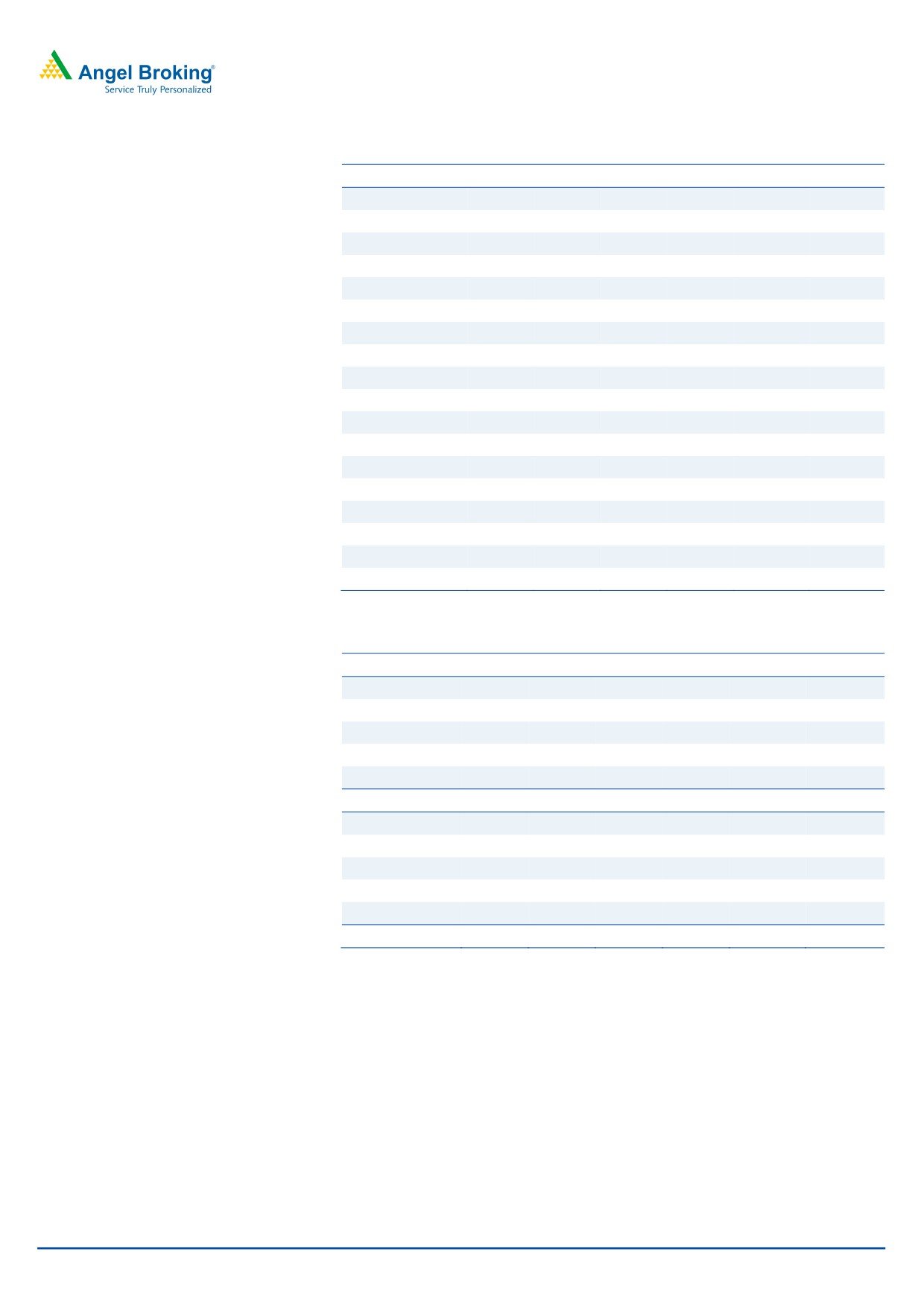

Asset quality stable for yet another quarter: DHFL has maintained stable asset

quality over the last few quarters. During Q1FY16, the company witnessed some

pressure on asset quality when the GNPAs went up to 0.98% from 0.93% in

Q4FY16. However, the current quarter has again been stable as far as asset

quality is concerned. Despite strong growth in the recent quarters and lending to

the LMI segment, which is perceived to be a risky segment, the company has been

able to maintain stable asset quality and hence, we don’t expect any deterioration

in the asset quality in the near term.

Exhibit 6: Asset quality remained stable

Exhibit 7: Cost / Income is trending down

1.20%

(%)

26.8

26.8

26.3

26.3

0.98%

28.0

25.3

0.96%

1.00%

0.93%

23.1

0.84%

24.0

0.81%

0.80%

20.0

0.60%

16.0

0.40%

12.0

0.20%

8.0

4.0

0.00%

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Source: Company, Angel Research

Source: Company, Angel Research

October 28, 2016

3

Dewan Housing Finance | 2QFY2017 Result Update

Outlook and valuation

The performance of DHFL in the first two quarters’ has been in line with the

expectations on all counts. Going ahead, we expect the company to post a healthy

AUM CAGR of 21% over FY2015-18E, which is likely to translate in earnings

CAGR of 23%, over the same period. The stock price has seen sharp run-up in the

last two quarters and despite of that is trading at a discount to other HFCs. At the

current level, the stock is valued at 1.5x FY2018E ABV. We have revised our target

price to `350 and maintain an ACCMULATE on the stock.

Company Background

Dewan Housing was established in 1984 by Late Shri Rajesh Kumar Wadhawan.

DHFL is a dominant player in niche markets (tier II & III cities) with strong foothold

in the low and middle income (LMI) segment. After the acquisition and merger of

First Blue Home Finance, DHFL now caters also to the middle and upper middle

income groups. The company operates in the mortgage financing business where

the growth and asset quality have remained healthy over the past few years.

The company has emerged as a one-stop-shop for its customers’ financial needs,

extending beyond home loans. The company has a presence in the education

loans, life insurance, and mutual funds segments through Avanse Education Loans,

DHFL Pramerica Life Insurance and DHFL Pramerica Asset Managers Pvt Ltd,

respectively.

It is India’s third largest private sector HFC with an AUM of `75,223cr as on

30th October, 2016. The company has a well diversified loan book with housing

loans accounting for the largest share of 70%, followed by LAP (15.7%), project

loans (11.5%) and loans to SME (2.6%) (as of 30th October, 2016).

October 28, 2016

4

Dewan Housing Finance | 2QFY2017 Result Update

Income statement (standalone)

Y/E March (` cr)

FY2013 FY2014

FY2015

FY2016

FY2017E

FY2018E

NII

678

888

1,256

1,664

2,050

2,500

- YoY Growth (%)

70.0

30.9

41.5

32.5

23.2

21.9

Other Income

280

296

265

164

175

188

- YoY Growth (%)

11.7

5.8

(10.5)

(38.3)

7.1

7.4

Operating Income

958

1,184

1,522

1,828

2,225

2,688

- YoY Growth (%)

47.5

23.6

28.5

20.1

21.7

20.8

Operating Expenses

304

384

480

550

616

691

- YoY Growth (%)

22.3

26.2

25.2

14.5

12.0

12.1

Pre - Provision Profit

654

801

1,041

1,278

1,609

1,997

- YoY Growth (%)

63.1

22.4

30.1

22.7

25.9

24.1

Prov. & Cont.

45

66

99

175

274

311

- YoY Growth (%)

89.9

47.7

48.7

77.4

56.2

13.5

Profit Before Tax

609

734

943

1,102

1,335

1,686

- YoY Growth (%)

61.4

20.5

28.4

16.9

21.1

26.3

Prov. for Taxation

159

206

322

373

456

575

- as a % of PBT

26.1

28.1

34.1

33.8

34.1

34.1

PAT

459

527

620

729

879

1,111

- YoY Growth (%)

60.9

14.8

17.8

17.6

20.6

26.3

Balance sheet (standalone)

Y/E March (` cr)

FY2013 FY2014

FY2015

FY2016

FY2017E

FY2018E

Share Capital

128

128

146

292

313

313

Reserve & Surplus

3,109

3,447

4,490

4,725

5,934

6,849

Loan Funds

27,441

33,890

40,526

49,800

61,730

76,519

- Growth (%)

61.9

23.5

19.6

22.9

24.0

24.0

Other Liab. & Prov.

5,172

6,465

9,557

13,115

14,901

18,246

Total Liabilities

35,850

43,930

54,718

67,933

82,878

1,01,928

Investments

275

721

1,006

1,249

1,524

4,080

Advances

32,403

38,651

48,789

60,572

73,898

88,677

- Growth (%)

77.5

19.3

26.2

24.2

22.0

20.0

Fixed Assets

438

988

985

1,222

1,491

1,834

Other Assets

2,735

3,569

3,938

4,889

5,965

7,336

Total Assets

35,850

43,930

54,718

67,933

82,878

1,01,928

October 28, 2016

5

Dewan Housing Finance | 2QFY2017 Result Update

Ratio analysis (standalone)

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Profitability ratios (%)

NIMs

2.6

2.4

2.8

2.9

2.9

2.9

Cost to Income Ratio

31.7

32.4

31.6

30.1

27.7

25.7

RoA

1.6

1.3

1.3

1.2

1.2

1.2

RoE

17.4

15.5

15.1

15.0

15.6

16.5

Asset Quality (%)

Gross NPAs

0.73

0.8

1.0

1.1

1.17

1.3

Net NPAs

0.48

0.5

0.7

0.8

0.82

0.8

Provision Coverage

34.2

33.5

28.7

31.5

33.1

38.6

Per Share Data (`)

EPS

17.9

20.5

21.3

24.9

28.1

35.5

ABVPS (75% cover.)

118.7

129.0

143.7

162.0

187.8

216.4

DPS

1.0

1.6

1.1

0.6

0.7

0.9

Valuation Ratios

PER (x)

18.2

15.8

15.3

13.1

11.6

9.2

P/ABVPS (x)

2.7

2.5

2.3

2.0

1.7

1.5

Dividend Yield

0.3

0.5

0.3

0.2

0.2

0.3

DuPont Analysis

NII

2.4

2.2

2.5

2.7

2.7

2.7

(-) Prov. Exp.

0.2

0.2

0.2

0.3

0.4

0.3

Adj. NII

2.2

2.1

2.3

2.4

2.4

2.4

Treasury

0.0

0.0

0.0

0.0

0.0

0.0

Int. Sens. Inc.

2.2

2.1

2.4

2.4

2.4

2.4

Other Inc.

0.9

0.7

0.5

0.3

0.2

0.2

Op. Inc.

3.2

2.8

2.9

2.7

2.6

2.6

Opex

1.1

1.0

1.0

0.9

0.8

0.7

PBT

2.1

1.8

1.9

1.8

1.8

1.8

Taxes

0.6

0.5

0.7

0.6

0.6

0.6

RoA

1.6

1.3

1.3

1.2

1.2

1.2

Leverage

10.9

11.7

12.0

12.7

13.4

13.7

RoE

17.1

15.5

15.1

15.0

15.6

16.5

October 28, 2016

6

Dewan Housing Finance | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Dewan Housing Finance

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 28, 2016

7